What is Insurance?

Insurance Policy: Insurance is a financial arrangement where an individual or an entity (such as a business) pays a premium to an insurance company in exchange for protection against the financial impact of certain risks or losses. The insurance company then assumes the risk and promises to compensate the policyholder if a covered loss occurs, up to the limits specified in the insurance policy.

Insurance policies can cover a wide range of risks, such as property damage, personal injury, illness, disability, and death. The specific terms and conditions of an insurance policy will vary depending on the type of coverage and the insurance company offering the policy.

In general, insurance serves as a way to manage risk and protect against unexpected financial losses. It allows individuals and businesses to transfer some of the potential financial burden of a loss to an insurance company, which can help mitigate the impact of the loss and provide peace of mind.

There are many types of insurance policies available, including auto insurance, home insurance, life insurance, health insurance, and business insurance. Each type of insurance policy has its own specific coverage, terms, and conditions, and it’s important to carefully review and understand the terms of any insurance policy before purchasing it.

What are the different types of insurance?

There are many different types of insurance, including auto insurance, home insurance, life insurance, health insurance, disability insurance, and business insurance.

How does insurance pricing work?

Insurance pricing is based on a number of factors, including the type and amount of coverage, the insured’s risk profile, and the insurer’s assessment of the likelihood and potential cost of a loss.

What is a deductible in insurance?

A deductible is the amount of money that the policyholder must pay out of pocket before their insurance coverage kicks in. Higher deductibles typically result in lower premiums, while lower deductibles result in higher premiums.

How does an insurance claim work?

When a covered loss occurs, the policyholder must file a claim with their insurance company. The insurer will investigate the claim and determine the extent of coverage. If the claim is approved, the insurer will pay out the agreed-upon amount to the policyholder.

How can I save money on insurance?

There are several ways to save money on insurance, including bundling policies, raising deductibles, and maintaining a good credit score. Additionally, shopping around and comparing quotes from multiple insurance companies can help ensure that you’re getting the best rate.

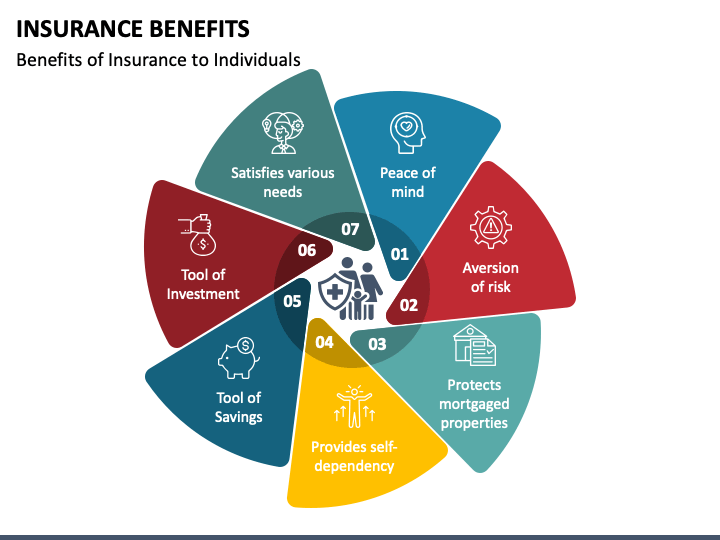

Benefits of Insurance

here are some benefits of insurance:

- Financial Protection: Insurance provides financial protection against unexpected events, such as accidents, illness, or natural disasters, which can cause significant financial losses.

- Risk Management: Insurance helps individuals and businesses manage their risk by transferring some of the potential financial burden of a loss to an insurance company.

- Peace of Mind: Knowing that you have insurance coverage can provide peace of mind and reduce anxiety about potential financial losses.

- Legal Compliance: Some types of insurance, such as auto insurance and workers’ compensation insurance, are required by law, so having insurance can ensure legal compliance.

- Asset Protection: Homeowners insurance and property insurance can provide protection for valuable assets, such as a home, car, or business property.

- Health Care Access: Health insurance provides access to necessary medical care and can help reduce the financial burden of healthcare expenses.

- Business Continuity: Business insurance can help protect a business from financial losses due to unexpected events, such as property damage, liability claims, or business interruption.

Overall, insurance provides individuals and businesses with a safety net against financial losses and can help ensure financial stability and security in the face of unexpected events.

Categories of Insurance

- Personal Insurance: This type of insurance is designed to protect individuals and families from financial losses. Examples include auto insurance, home insurance, health insurance, life insurance, and disability insurance.

- Commercial Insurance: Commercial insurance is designed to protect businesses from financial losses. Examples include commercial property insurance, liability insurance, workers’ compensation insurance, and business interruption insurance.

- Specialty Insurance: This type of insurance covers unique risks that are not typically covered by standard insurance policies. Examples include travel insurance, pet insurance, event insurance, and cyber insurance.

- Government Insurance: Some insurance programs are administered by government agencies, such as social security disability insurance and flood insurance through the National Flood Insurance Program.

- International Insurance: International insurance policies are designed to protect individuals and businesses while they are traveling or working overseas. Examples include international health insurance, international property insurance, and travel insurance.

- High-Risk Insurance: High-risk insurance policies are designed for individuals or businesses that have a high likelihood of experiencing a loss or that have a history of claims. Examples include high-risk auto insurance, high-risk homeowner’s insurance, and high-risk business insurance.

These are just a few examples of the many categories of insurance that exist. Each category may include a variety of specific policies and coverages designed to address different risks and needs.

AAA Insurance Moore Oklahoma

AAA Insurance is one of the most trusted insurance providers in the United States, and the AAA Insurance office in Moore, Oklahoma is no exception. Located at 616 SW 4th Street, Suite 200, the AAA Insurance office in Moore offers a wide range of insurance products to meet the needs of individuals and families in the area.

Auto insurance is one of the most popular products offered by AAA Insurance in Moore. As a member of AAA, customers can receive discounts on their auto insurance premiums, as well as benefits such as roadside assistance and travel discounts. The knowledgeable agents at the Moore office can help customers choose the coverage options that are right for them, including liability, collision, and comprehensive coverage.

Homeowners insurance is another important product offered by AAA Insurance in Moore. Homeowners insurance can provide protection for the structure of a home, as well as personal property and liability. AAA Insurance offers a range of coverage options, including coverage for natural disasters such as tornadoes and hail storms that are common in Oklahoma.

In addition to auto and homeowners insurance, AAA Insurance in Moore also offers other types of insurance products. These include:

Renters insurance: Renters insurance can provide protection for personal property in a rented home or apartment, as well as liability coverage.

Life insurance: Life insurance can provide financial protection for loved ones in the event of a policyholder’s death. AAA Insurance offers term, whole, and universal life insurance options.

Business insurance: AAA Insurance can provide coverage for small businesses in a variety of industries, including liability, property, and workers’ compensation insurance.

One of the benefits of choosing AAA Insurance in Moore is the personalized service that customers receive. The agents at the Moore office take the time to get to know their customers and understand their unique insurance needs. This allows them to provide tailored recommendations and solutions that meet each customer’s individual needs.

Another benefit of choosing AAA Insurance is the company’s commitment to customer service. AAA Insurance has a reputation for excellent customer service, and the Moore office is no exception. Customers can expect prompt and courteous service from the agents at the Moore office, whether they are purchasing a new policy or making a claim.

Overall, AAA Insurance in Moore, Oklahoma is a trusted provider of insurance products for individuals and families in the area. With a wide range of coverage options and a commitment to personalized service and customer satisfaction, AAA Insurance is a great choice for those seeking insurance coverage in Moore and beyond.

what is an Insurance Stamp

An insurance stamp is a physical or digital proof of insurance coverage that is often required by various organizations and government entities. It is typically a document or certificate that includes important details about the insurance policy, such as the policyholder’s name, the type of insurance coverage, and the coverage period.

In the past, insurance stamps were physical rubber stamps that were used to stamp insurance policies to indicate that the policyholder had paid their premium and was covered under the policy. However, with the advent of digital records and online transactions, physical stamps are becoming less common.

Today, many insurance companies provide digital insurance stamps that can be downloaded and printed by the policyholder. These stamps are often used as proof of insurance coverage when registering a vehicle, obtaining a driver’s license, or applying for a loan. Some states also require insurance companies to provide electronic insurance stamps that can be accessed and viewed online by authorized entities.

In summary, an insurance stamp is a document or certificate that serves as proof of insurance coverage. It is often required by various organizations and government entities to ensure that policyholders have the necessary insurance coverage.

Insurance stamp for registration Massachusetts

In Massachusetts, an insurance stamp is not required for registration of a vehicle. Instead, proof of insurance must be presented in the form of an insurance certificate, which is issued by the insurance company providing coverage. The insurance certificate must be presented at the time of registration, along with other required documents and fees.

The insurance certificate must contain the following information:

- The name of the insurance company providing coverage

- The policy number

- The policy effective dates

- A description of the vehicle(s) covered under the policy

- The name of the policyholder

Massachusetts law requires all drivers to carry a minimum amount of liability insurance coverage. The minimum coverage amounts are:

- $20,000 per person for bodily injury

- $40,000 per accident for bodily injury

- $5,000 per accident for property damage

It’s important to note that these are only the minimum required coverage amounts. Many drivers choose to carry higher amounts of coverage to ensure they are adequately protected in the event of an accident.

In summary, in Massachusetts, an insurance stamp is not required for vehicle registration. Instead, proof of insurance must be presented in the form of an insurance certificate that includes the required information. It’s important to make sure you have the minimum required insurance coverage, and many drivers choose to carry higher amounts of coverage for added protection.

Amica Insurance Revenue

As of my knowledge cutoff date of September 2021, Amica Insurance had reported revenue of $2.1 billion for the fiscal year 2020. However, it’s important to note that revenue can vary from year to year and is subject to change based on various factors such as market conditions, changes in consumer behavior, and company performance.

Cigna Insurance Reddit

There are various discussions on Reddit related to Cigna Insurance, with users sharing their experiences, opinions, and questions about the company’s insurance products and services. Here are a few examples of what you might find on Reddit related to Cigna Insurance:

- Users discussing their experiences with Cigna’s health insurance plans, including their coverage, customer service, and premiums.

- Users asking questions about Cigna’s insurance products and services, such as what types of coverage they offer and how to sign up for a plan.

- Users sharing their opinions on Cigna’s policies and practices, including their stance on certain healthcare issues and their involvement in the healthcare industry.

It’s important to note that the opinions shared on Reddit are those of individual users and may not necessarily be representative of the experiences of all Cigna customers. If you are considering purchasing insurance from Cigna, it’s a good idea to research the company’s offerings and read reviews from multiple sources to get a well-rounded understanding of their products and services.

Insurance Broker of Record

An insurance broker of record is a licensed insurance professional who is designated by a client to act as their primary representative and advocate with insurance carriers. In essence, the broker of record serves as the client’s authorized agent in all insurance matters.

When a client designates a broker of record, that broker assumes responsibility for managing the client’s insurance program, including negotiating with carriers, advising on coverage options, and placing coverage. The broker of record may also be responsible for coordinating with other insurance professionals, such as underwriters and claims adjusters, on behalf of the client.

A broker of record agreement is a document that formalizes the relationship between the client and the designated broker. This agreement may include details such as the scope of services to be provided, compensation arrangements, and the duration of the agreement.

It’s important for clients to carefully consider their choice of broker of record, as this individual will have significant influence over their insurance program. Clients may want to consider factors such as the broker’s experience and expertise, their reputation in the industry, and their ability to effectively advocate on the client’s behalf.

In summary, an insurance broker of record is a licensed insurance professional designated by a client to act as their primary representative and advocate with insurance carriers. The broker assumes responsibility for managing the client’s insurance program, and the relationship is formalized through a broker of record agreement.

Broker of Record Insurance

A broker of record is a licensed insurance professional who is designated by a client to act as their primary representative and advocate with insurance carriers. The broker of record assumes responsibility for managing the client’s insurance program, including negotiating with carriers, advising on coverage options, and placing coverage.

In the insurance industry, a broker of record letter (BOR) is a document that allows a new broker to take over as the primary representative for an insurance policy. The BOR is typically provided by the client and must be signed by both the client and the current broker of record to be valid.

Once the BOR is in effect, the new broker assumes responsibility for managing the client’s insurance program, and the previous broker is no longer authorized to act on behalf of the client in insurance matters. The new broker is responsible for coordinating with carriers, advising on coverage options, and placing coverage.

It’s important to note that a BOR does not cancel an existing insurance policy. Instead, it simply designates a new broker as the primary representative for the policy. The new broker is responsible for reviewing the existing policy and making any necessary changes or adjustments.

In summary, a broker of record is a licensed insurance professional designated by a client to act as their primary representative and advocate with insurance carriers. A broker of record letter is a document that allows a new broker to take over as the primary representative for an insurance policy. The new broker assumes responsibility for managing the client’s insurance program, and the previous broker is no longer authorized to act on behalf of the client in insurance matters.

Car Insurance Windsor

Windsor is a city located in Ontario, Canada. If you are looking for car insurance in Windsor, there are several options available to you.

Firstly, you can start by researching and comparing quotes from various insurance providers in the area. Some popular car insurance companies in Windsor include Intact Insurance, Aviva Canada, TD Insurance, and Desjardins Insurance, among others.

It’s important to consider factors such as coverage options, premiums, deductibles, and customer service when comparing car insurance providers. You may also want to read reviews from other customers to get an idea of their experiences with different insurance companies.

In addition to traditional car insurance providers, you may also consider getting car insurance through a membership-based organization such as CAA South Central Ontario. CAA offers car insurance to members and provides a range of benefits such as roadside assistance, travel insurance, and discounts on various services.

Another option to consider is bundling your car insurance with other insurance policies such as home insurance or life insurance. Many insurance providers offer discounts for customers who have multiple policies with them.

In summary, if you’re looking for car insurance in Windsor, start by researching and comparing quotes from various insurance providers. Consider factors such as coverage options, premiums, deductibles, and customer service. You may also want to consider getting car insurance through a membership-based organization or bundling your car insurance with other insurance policies to save money.

AAA Insurance Sand Springs

AAA Insurance is a well-known insurance provider in the United States. If you are looking for AAA insurance in Sand Springs, Oklahoma, there are several options available to you.

One option is to visit a local AAA office in Sand Springs. There, you can speak with an agent who can provide you with information about the insurance products and services available to you, including auto insurance, home insurance, and life insurance.

Another option is to visit the AAA website and explore the insurance products and services available to you online. You can also obtain a quote for auto insurance, home insurance, or other types of insurance directly from the website.

AAA offers a range of benefits to its members, including roadside assistance, travel discounts, and exclusive member savings on insurance products. If you are already a AAA member, be sure to inquire about any discounts or benefits that may be available to you.

When choosing an insurance provider, it’s important to consider factors such as coverage options, premiums, deductibles, and customer service. You may also want to read reviews from other customers to get an idea of their experiences with AAA Insurance in Sand Springs.

In summary, if you’re looking for AAA insurance in Sand Springs, Oklahoma, visit a local AAA office or explore the insurance products and services available online. Be sure to consider factors such as coverage options, premiums, deductibles, and customer service when choosing an insurance provider.

Keiser University Health Insurance

Keiser University is a private university located in Florida, USA. As a student at Keiser University, you may be eligible for health insurance through the university.

Keiser University offers health insurance plans to its students through UnitedHealthcare StudentResources. These plans provide coverage for a range of medical services, including doctor visits, hospitalization, prescription drugs, and mental health care.

The cost of the health insurance plan will depend on various factors such as the level of coverage you choose and the duration of coverage. You can obtain more information about the cost of the health insurance plan by visiting the Keiser University website or speaking with a representative from the university’s Student Services department.

It’s important to note that health insurance is not mandatory for students at Keiser University. However, it’s highly recommended that students have some form of health insurance coverage to protect themselves in case of illness or injury.

In summary, Keiser University offers health insurance plans to its students through UnitedHealthcare StudentResources. The cost of the plan will depend on the level of coverage you choose and the duration of coverage. Health insurance is not mandatory for students at Keiser University but is highly recommended for protection in case of illness or injury.

Trustage Health Insurance

TruStage Health Insurance is a product offered by CUNA Mutual Group, a financial services company that specializes in insurance and investment products for credit unions and their members.

TruStage Health Insurance is available to members of participating credit unions and provides a range of health insurance options for individuals and families. The plans are underwritten by various insurance companies and offer coverage for medical services such as doctor visits, hospitalization, prescription drugs, and more.

One of the advantages of TruStage Health Insurance is that it is designed to be affordable for credit union members. The plans are competitively priced and may offer lower premiums and deductibles than other health insurance options.

TruStage Health Insurance also offers a variety of plan options, including traditional fee-for-service plans, health savings account (HSA) plans, and preferred provider organization (PPO) plans. This allows individuals and families to choose the plan that best meets their healthcare needs and budget.

It’s important to note that TruStage Health Insurance is not available in all states and is subject to state regulations. It’s recommended that you check with your credit union or visit the TruStage Health Insurance website to see if the product is available in your area.

In summary, TruStage Health Insurance is a health insurance product offered by CUNA Mutual Group to members of participating credit unions. The plans offer a range of coverage options and are designed to be affordable for credit union members. However, availability may vary by state, so it’s important to check with your credit union or visit the TruStage Health Insurance website to see if the product is available in your area.

Ovid Life Insurance

Ovid is a life insurance company that offers online life insurance policies to consumers. Ovid’s policies are designed to be simple and easy to understand, with a focus on providing coverage that is affordable and accessible to a wide range of consumers.

Ovid’s life insurance policies are available to individuals between the ages of 18 and 64, with coverage amounts ranging from $50,000 to $1 million. The company offers both term life insurance and permanent life insurance policies, depending on the individual’s needs and preferences.

One of the unique features of Ovid’s life insurance policies is that they can be purchased entirely online, without the need for an in-person meeting with an agent. The application process is designed to be simple and straightforward, with applicants able to get a quote and apply for coverage in just a few minutes.

Ovid’s life insurance policies also come with a number of additional benefits, including the ability to customize coverage amounts and payment options, as well as access to free online tools and resources to help consumers better understand their coverage and make informed decisions about their insurance needs.

Overall, Ovid is a good option for consumers who are looking for a simple and affordable life insurance policy that can be purchased entirely online. However, as with any life insurance policy, it’s important to carefully review the terms and conditions of the policy to ensure that it meets your needs and preferences.

Conclusion:

In conclusion, insurance is an important financial tool that provides individuals and businesses with protection against unexpected events and potential financial losses. There are many different types of insurance, each designed to address specific risks and needs. Insurance can provide peace of mind, legal compliance, and asset protection, among other benefits. By understanding the different types of insurance available and working with a reputable insurance provider, individuals and businesses can ensure that they have the coverage they need to protect themselves from financial losses and maintain financial stability and security.